ESG, Greenwashing, and the Department of Justice

April 29, 2022

The first time I heard that the Securities Exchange Commission (“SEC”) and the Federal Trade Commission (“FTC”) were forming tasks forces related to “ESG”, I assumed that it must involve some kind of weight loss herbal supplement. (Sounds like HCG, and I am always looking for the latest weight loss trend…?) Not quite.

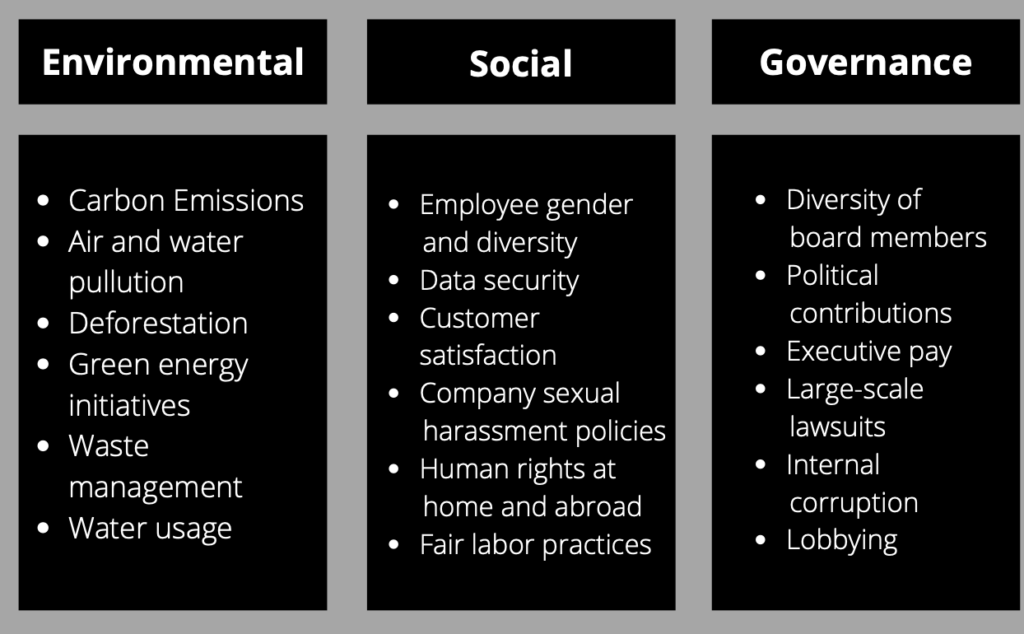

What is ESG, anyway? ESG is a term to describe a system designed to measure the sustainability of a company, in three specific non-financial categories: Environmental, Social and Governance. In essence, 1) environmental factors evaluate conservation, or the “greenness” of a company; 2) social factors related to how a company treats its employees and others; and 3) governance factors measure how a company is being run. The following table sets forth some examples in each category:

What does the SEC, FTC, and DOJ have to do with ESG?

In his remarks to the American Bar Association Institute on White Collar Crime on March 3, 2022, Attorney General Merrick Garland included ESG in the Department of Justice’s (“DOJ”) list of priorities for the coming year. Why does DOJ care about ESG? The FTC has, for several years, been policing against corporate “greenwashing,” or the gap between the symbolic and substantive action taken by a company in order to gain an environmentally-friendly image. After forming a Climate and ESG Task Force in March of 2022, the Securities Exchange Commission (“SEC”) now regularly scrutinizes public company filings, reports, and statements on climate, sustainability and ESG. See Jonathan Brightbill and Jennie Porter, SEC Demanding Climate and ESG Disclosures, Winston’s Environmental Law Update (Sept.28, 2021), https://www.winston.com/en/winston-and-the-legal-environment/sec-demanding-expanded-climate-and-esg-disclosures.html. After DOJ’s announcement that it too is entering the ESG regulation game, the stakes are even higher for companies making ESG claims in their disclosures.

As noted by Kelly Gibson, the Director of the SEC’s Philadelphia Regional Office, and SEC’s ESG’s task force, because there has been a “dramatic surge in popularity for ESG focused investment funds, without an associated evolution in law and ESG criteria, there is a high risk that investors may be misled by greenwashing.” Ms. Gibson noted that the SEC is not the “environmental police,” but instead has the goal of “making sure that investors are given the most accurate information possible in a timely manner, and that advisors are doing what they say they’ll do.” Showing that it intends to make good on its own promise, DOJ recently chastised Deutsche Bank, claiming the bank overstated its investments in ESG initiatives and operations by hundreds of billions of dollars. Deutsche Bank currently has a deferred prosecution agreement with the government which requires it to report any potential new legal issues as soon as it found out about them.

With this spotlight on ESG disclosures, companies must take prompt action, in consultation with counsel, to address potential problems, including the installation of a robust internal compliance program. Failure to do so could result in severe civil sanctions, the appointment of a monitor, or criminal prosecution for fraud. For additional questions, please do not hesitate to e-mail me at